Revised tax invoice and credit or debit notes 1 A revised tax invoice referred to in section 31 and credit or debit note referred to in section 34 shall contain the following particulars - a the. It is an additional requirement Declaration under Rule 46 s that needs to be fulfilled while generating a tax invoice by the registered person to.

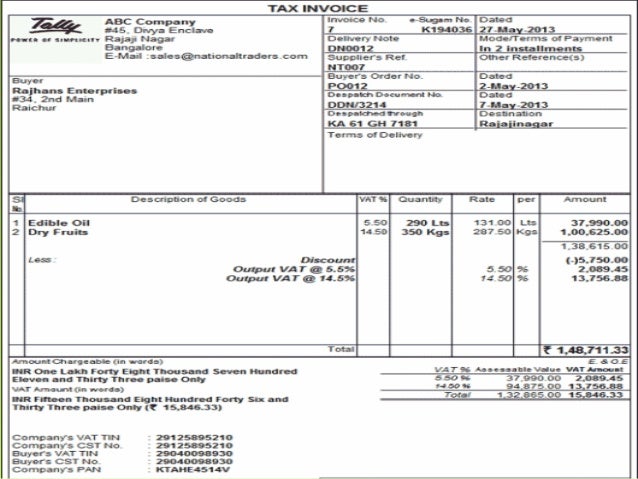

Gst Tax Invoice Format In Excel Gst Tax Invoice Format Exe Invoice Format In Excel Invoice Format Invoice Template Word

It is commonly known as Invoice or Tax Invoice.

. GST Invoice issued must be compliant with the GST rules and regulations for all supply of goods and services. GST Invoice Payment Rules. Calculate GST on tax invoices There are 2 ways to compute the total GST amount on your tax invoice when your customer purchases several items of standard-rated supplies.

Under the GST regime an invoice or tax invoice means the tax invoice referred to in section 31 of the CGST Act 2017. Usually an invoice is issued to charge tax as well as to claim. If a registered entity makes a payment to an unregistered entity the former has to issue a GST invoice.

What this Ruling is about. It is necessary for any type of sellers to. 1 It also explains when.

Under the GST regime an invoice or tax invoice means the tax invoice referred to in section 31 of the CGST Act 2017. Gst Invoice Format Rules Download Sample Tax Invoice Indiafilings All About Gst E Invoice Generation System On Portal With Applicability Sales Tax In Canada Hst Gst Pst When You Re. Rule 46 s of CGST Rules2017.

Ad Send Customized Invoices Easily Track Expenses More. This Ruling sets out the information requirements for a tax invoice under subsection 29-70 1 of the A New Tax System Goods and Services Tax Act 1999 GST Act. In case a registered entity receives a productservice that is.

Pages in this section Rules for tax invoices are changing on 1 April. Under GST invoice rules any GST registered business owner supplying goods or services must issue Tax invoices to its buyer. As per rule 46 of the Central Goods and Service Tax Rules 2017 the length of the GST invoice number should not exceed 16 characters which means that the GST invoice.

This section mandates the issuance of an invoice or a bill of supply for. GST-registered customers should issue tax invoices for taxable supplies and keep records to support expense claims. This section mandates issuance of invoice or a bill of supply for every.

Ad Send Customized Invoices Easily Track Expenses More. This Ruling sets out the information requirements for a tax invoice under subsection 29-701 of the A New Tax System Goods and Services Tax Act 1999 GST. The Government has passed legislation regarding the GST tax invoice rules and these were implemented in India on July 1 st 2017.

India Intangible Assets Buyback Taxes And Gst International Tax Review

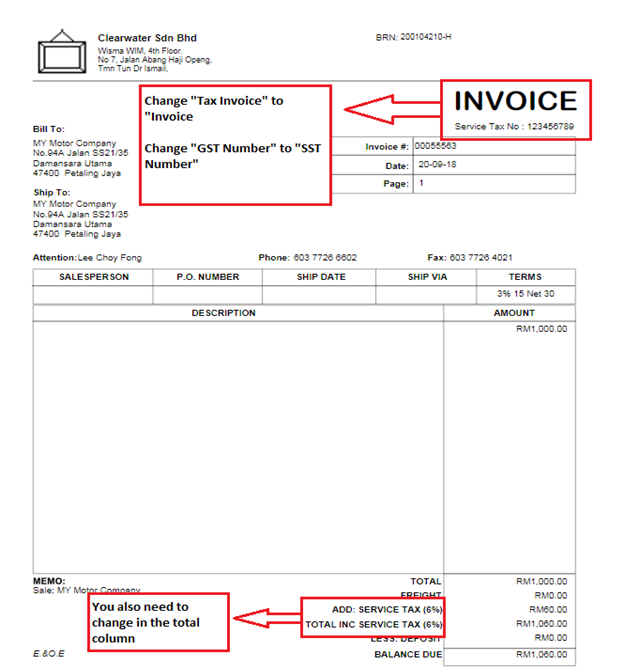

Sst Customized Form Abss Support

Gst Tax Invoice Ruling Addisondvk

How To Revise Invoice In Gst Important Things To Know

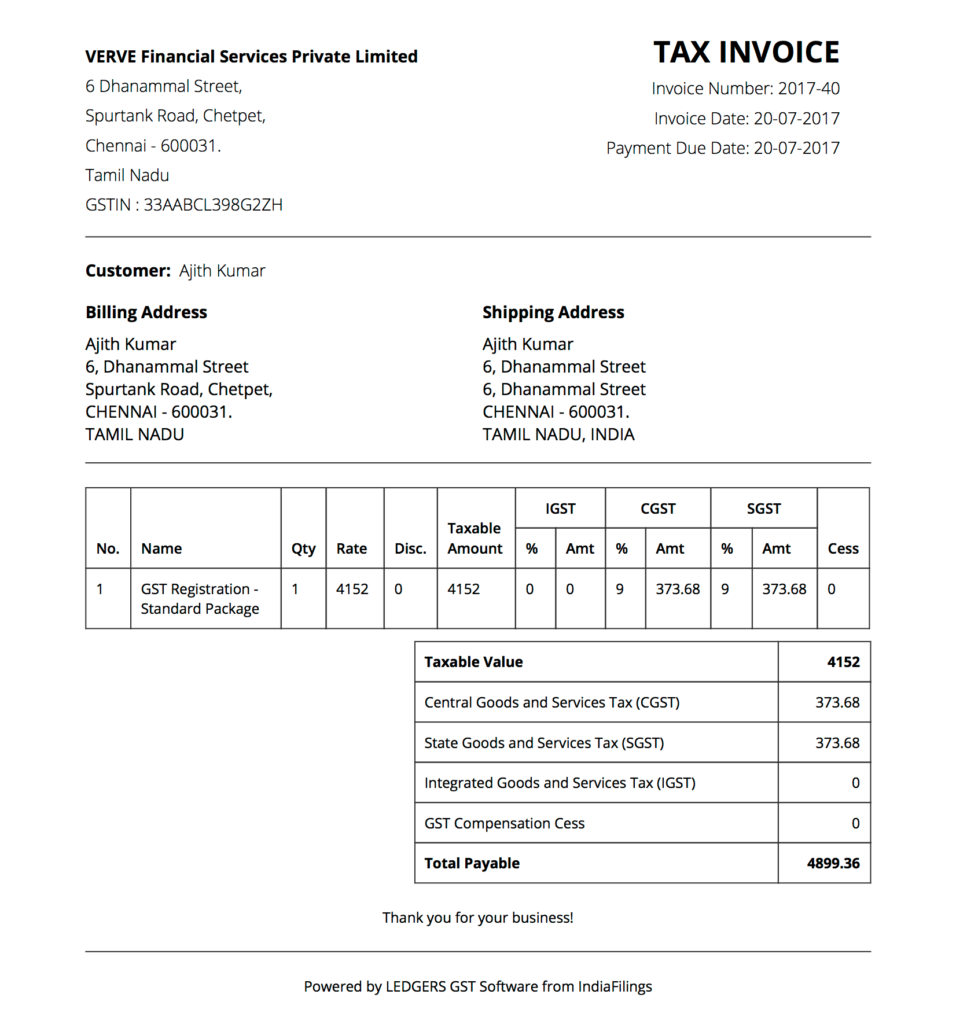

Gst Invoice Format Rules Download Sample Tax Invoice Indiafilings

Browse Our Example Of Construction Tax Invoice Template Invoice Template Invoice Example Invoice Template Word

Gst Invoice Comprehensive Guide With Invoice Formats Examples

What Is The Rule For An Invoice Number With A Change Of Financial Year Under The Gst Quora

Simple Gst Invoice Format In Pdf1 Simple Invoice Template Word Details Of Simple Invoice Template Wor In 2022 Invoice Template Word Invoice Format Invoice Template

Gst Tax Invoice Ruling Addisondvk

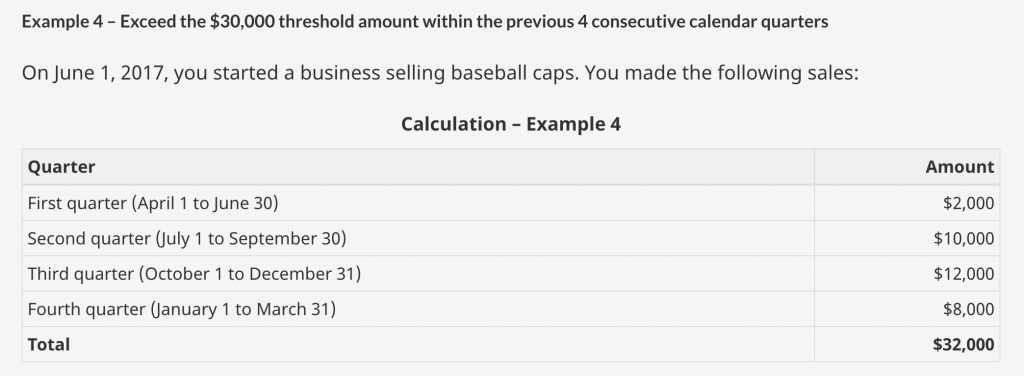

Gst Hst Technical Information Bulletin Agence Du Revenu Du

Gst Turnover Threshold Goods And Service Tax The Next

Gst Tax Invoice Format In Excel Word Pdf And Pdf Invoice Format In Excel Invoice Template Word Invoice Format

Gst Registration Process Flow Chart Flow Chart Process Flow Chart Process Flow

Sales Tax In Canada Hst Gst Pst When You Re Self Employed

Cbic Circular On Penalties For Fake Invoice Transactions May Lead To Fewer Arrests Says Expert